Insurance 2035: Innovation for a Digitally-Driven Risk Landscape

- Petar Dimov

- Apr 30, 2025

- 7 min read

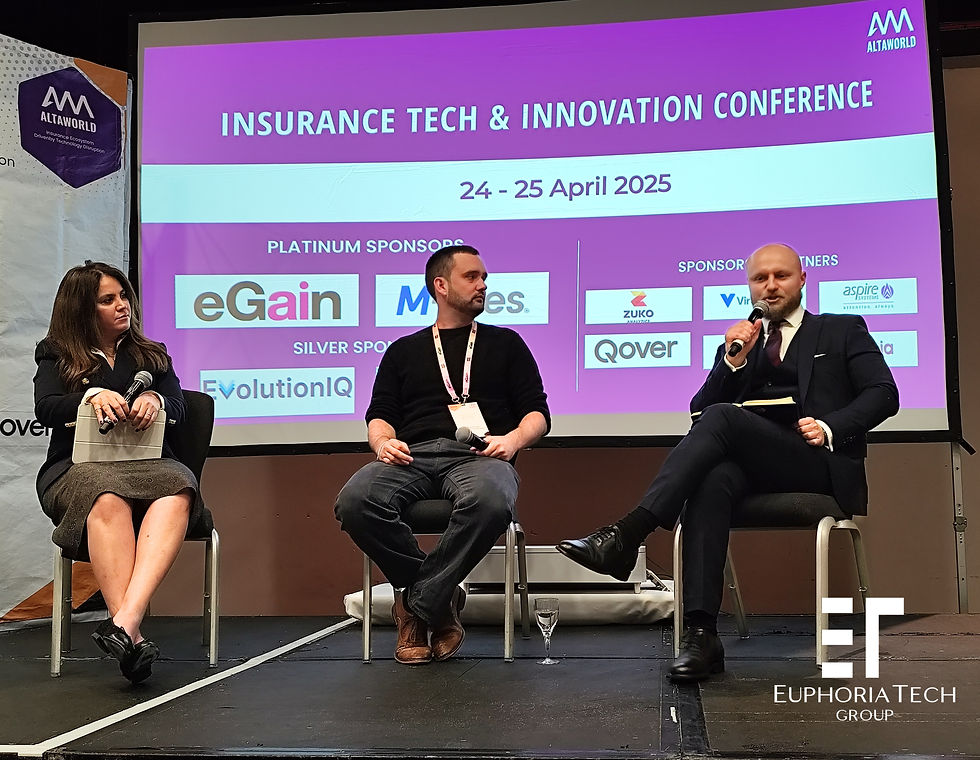

Fresh from the 𝗜𝗧𝗜𝗖-𝗟𝗼𝗻𝗱𝗼𝗻 𝟮𝟬𝟮𝟱 conference last week, I’m energized by the insights, ideas, and inspiring conversations with insurance leaders, innovative startups, and tech disruptors!

It was an absolute honour to moderate a fantastic panel discussion alongside Sean Spain and Zainab Ibrahim. Our panel, titled 𝗜𝗻𝘀𝘂𝗿𝗮𝗻𝗰𝗲 𝗳𝗼𝗿 𝘁𝗵𝗲 𝗗𝗶𝗴𝗶𝘁𝗮𝗹 𝗘𝗰𝗼𝗻𝗼𝗺𝘆 – 𝗖𝗿𝗲𝗮𝘁𝗶𝗻𝗴 𝗡𝗲𝘄 𝗣𝗿𝗼𝗱𝘂𝗰𝘁𝘀 𝗳𝗼𝗿 𝗘𝗺𝗲𝗿𝗴𝗶𝗻𝗴 𝗥𝗶𝘀𝗸𝘀, sparked a dynamic exchange on what the future holds for risk management in an AI- and quantum-driven world.

This article dives deeper into many of the themes we discussed, drawing on global trends, expert analysis, and forward-looking scenarios. If you work in insurance, technology, risk, or regulation—this one’s for you.

Key Takeaways

Research suggests the insurance market for digital economy risks could grow significantly by 2035, driven by emerging threats such as agentic AI, robotics, spacetech, and quantum computing.

Cyber insurance will likely remain foundational, evolving to cover AI and quantum-related breaches, with new products emerging for AI liability, blockchain, and robotics risks.

Parametric and usage-based insurance are poised to gain traction, offering flexible coverage triggered by specific events (e.g., cyber incidents) or personalized premiums based on IoT data.

Novel risk categories like space debris and quantum encryption breaches could lead to the development of highly specialized insurance products.

Controversy persists in volatile domains such as cryptocurrency, with insurers wary due to regulatory uncertainty, limited historical data, and growing ethical concerns around AI and robotics liability.

Overview

The digital economy—defined by economic activity powered by digital technologies and the internet—is giving rise to a wave of emerging risks that traditional insurance models struggle to cover. These include cybersecurity threats, AI-related liabilities, data breaches, robotics malfunctions, blockchain and cryptocurrency risks, as well as hazards from spacetech and quantum computing. In response, the insurance industry is beginning to develop innovative products and risk frameworks tailored to these challenges. This article provides a comprehensive analysis of how insurance is expected to evolve by 2035, drawing on insights from industry reports, expert forecasts, and market trends to inform stakeholders navigating the future of risk in a rapidly digitizing world.

Key Insurance Products for Emerging Digital Risks

Cyber Insurance: A Pillar of Digital Risk Management

Cyber insurance has become a critical product for businesses in the digital economy, covering financial losses resulting from cyber threats such as data breaches, ransomware attacks, and business email compromise. The cost of cybercrime is projected to reach $10.5 trillion annually in 2025, underscoring the need for robust coverage.

Coverage details include:

First-party losses: Costs related to theft of funds, data, or damage to digital assets.

Third-party losses: Liability claims arising from cyber events, such as legal defense costs and compensation for affected parties.

Additional services: Many policies include proactive measures like cybersecurity assessments, incident response support, and access to forensic experts, as highlighted by providers like Chubb and AXIS.

Leading providers like AIG, Chubb, and Munich Re offer comprehensive cyber insurance solutions, often tailored to specific industries such as healthcare, manufacturing, and technology.

AI Risk Insurance: Addressing Algorithmic and Ethical Risks

As artificial intelligence (AI) becomes more integrated into business operations, new risks such as algorithmic bias, decision-making errors, and liability for AI-driven outcomes are emerging. AI risk insurance is a nascent but growing area, with insurers beginning to develop products to cover these risks. Deloitte projects that by 2032, insurers could write around $4.7 billion in annual global AI insurance premiums, indicating significant growth potential.

Potential coverage includes:

Algorithmic errors: Financial losses or legal liabilities resulting from AI system failures or biased outcomes, as discussed by IBM.

Regulatory compliance: Coverage for fines or penalties related to non-compliance with AI regulations.

Third-party liability: Protection against claims arising from AI decisions that harm individuals or businesses, as mentioned in Oxford University research.

Challenges include the black-box nature of AI systems, making it difficult to assess and price risks accurately. Insurers are exploring ways to incorporate predictive analytics and risk modeling to address this.

Blockchain and Cryptocurrency Insurance: Securing Digital Assets

The rise of blockchain technology and cryptocurrencies has introduced unique risks, such as theft of digital assets, smart contract failures, and regulatory uncertainties. Insurance products are being developed to mitigate these risks, though adoption is cautious due to market volatility and regulatory challenges.

Coverage types include:

Cryptocurrency theft: Protection for exchanges, custodians, and individuals against losses from hacks or fraud, as offered by Superscript and CoinCover.

Smart contract risks: Coverage for losses due to errors or exploits in blockchain-based smart contracts.

Regulatory risks: Assistance with compliance issues or legal challenges related to blockchain operations.

Examples include Lemonade's use of blockchain for crop insurance in Africa, automating claims based on weather data. However, traditional insurers are hesitant due to the lack of historical data and market volatility.

Parametric Insurance: A Flexible Solution for Emerging Risks

Parametric insurance is gaining traction as a way to cover emerging risks in the digital economy. Unlike traditional insurance, which pays out based on actual losses, parametric insurance triggers payouts based on predefined parameters or events.

Relevance to digital risks includes:

Cyber events: Payouts triggered by specific cyber incidents, such as a ransomware attack or data breach.

AI risks: Coverage based on metrics like the number of biased decisions made by an AI system.

Blockchain risks: Payouts triggered by events like a smart contract failure or a significant drop in cryptocurrency value.

Advantages include faster and more straightforward administration, making it suitable for risks where traditional loss assessment is challenging.

Usage-Based Insurance (UBI): Leveraging Digital Data

Usage-Based Insurance (UBI) is a type of insurance where premiums are based on actual usage, often tracked through telematics devices or IoT sensors. This model is particularly relevant in the digital economy, where connected devices generate vast amounts of data.

Examples include:

Automotive insurance: Pay-as-you-drive models that adjust premiums based on driving behavior, distance traveled, or time of day.

IoT-enabled insurance: Policies that use data from smart devices to assess risk and offer personalized pricing.

UBI demonstrates how digital technologies can be used to create more dynamic and customer-centric insurance products, aligning with the data-driven nature of the digital economy.

Insurance for Emerging Digital Risks Beyond Cyber and AI

Gig Economy Risks:

Description: The rise of platform-based work (e.g., Uber, Airbnb) has created new risks related to worker classification, liability, and benefits, as noted by McKinsey.

Products: Specialized insurance for gig workers, such as ride-sharing liability coverage or host insurance for short-term rentals.

Cloud Service Risks:

Description: Businesses increasingly rely on cloud services, introducing risks like data loss, service outages, or vendor breaches.

Products: Cloud-specific insurance that covers data recovery, business interruption, and third-party liability.

NFT and Digital Asset Risks:

Description: With the growth of non-fungible tokens (NFTs) and other digital assets, there are risks related to intellectual property disputes, smart contract failures, and market volatility.

Products: Emerging insurance solutions for NFT creators and collectors, covering theft, fraud, and legal disputes.

2030–2035: Insuring the Next Frontier of Technology

Robotics and Humanoid Robots Insurance: Securing Autonomous Systems

The proliferation of robotics, including humanoid robots, will introduce risks such as physical harm, malfunctions, and cybersecurity breaches. As robotics and autonomous vehicles become ubiquitous, insurance products will need to address liabilities arising from accidents or malfunctions, with coverage for humanoid robots requiring new underwriting models to assess human-like behavior and interaction risks.

Coverage Types:

Physical Harm: Covering accidents involving robots in workplaces or public spaces, as noted by McKinsey.

Cybersecurity Risks: Protecting against hacking of robotic systems.

Liability for Autonomous Actions: Determining responsibility when a robot acts independently.

By 2035, robotics insurance may expand to cover advanced humanoid robots used in healthcare, manufacturing, and service industries, with policies addressing both physical and digital risks.

Spacetech Insurance: Covering the New Frontier

The growing space economy will necessitate insurance for space assets like satellites, space stations, and interplanetary missions, covering risks such as space debris collisions, launch failures, and extraterrestrial environmental hazards. As spacetech advances, insurers will need to address novel risks like space tourism accidents and space weather events.

Coverage Details:

Space Debris and Collisions: Protecting against damage to satellites from space debris.

Launch Failures: Covering losses from rocket launch failures.

Space Tourism Liabilities: Insuring against injuries or fatalities during space travel.

Spacetech insurance may become a significant market by 2035, with policies covering commercial spaceflight, lunar bases, and asteroid mining operations

Quantum Computing Risk Management: Securing Against New Threats

Quantum computing poses significant risks to current encryption methods, leading to potential data breaches on an unprecedented scale. Insurers will offer policies that cover losses from quantum-enabled cyber attacks and assist businesses in transitioning to post-quantum cryptography, addressing risks like intellectual property theft or competitive disadvantages.

Coverage Types:

Quantum-Safe Cyber Insurance: Covering losses from quantum-enabled cyber attacks.

Transition Support: Assisting businesses in adopting post-quantum cryptography.

Intellectual Property Insurance: Protecting against theft or loss of IP due to quantum computing capabilities.

Quantum computing risk management will be a critical area, with insurers developing specialized products to mitigate the disruptive potential of quantum technologies.

Challenges and Opportunities in Developing New Insurance Products

Challenges:

Regulatory Uncertainty: Many digital risks, such as AI and blockchain, operate in regulatory gray areas, making it difficult for insurers to design and price products.

Data Gaps: Insurers rely on historical data to assess risk, but many digital risks are too new to have sufficient data for accurate modeling.

Volatility: The fast-paced and volatile nature of the digital economy, particularly in areas like cryptocurrency, makes risk assessment challenging.

Opportunities:

Innovation: Insurers can leverage technologies like AI, blockchain, and IoT to create more efficient and personalized products.

Market Growth: The digital economy is expanding rapidly, creating new markets for insurance products tailored to emerging risks.

Partnerships: Collaboration with tech companies and startups can help insurers develop cutting-edge solutions.

Conclusion: Embracing the Future of Risk

The digital economy has ushered in a new era of complex and evolving risks, prompting insurers to rethink traditional models and innovate rapidly. While cyber insurance has matured into a critical pillar of digital risk management, emerging technologies like AI, blockchain, robotics, and quantum computing are introducing novel threats—from algorithmic bias and smart contract failures to space tourism liabilities and quantum-enabled cyberattacks.

From 2025 to 2035, the insurance industry is expected to undergo transformative growth through technological innovation, regulatory adaptation, and global collaboration. Flexible solutions such as parametric insurance and usage-based models will become increasingly relevant, helping insurers respond to dynamic digital threats with greater speed and precision.

Despite ongoing challenges like regulatory uncertainty and data scarcity, the sector is well-positioned to expand its role in protecting digital and physical assets. As insurers continue to develop specialized products for the digital age, they will play a pivotal role in fostering economic resilience, ethical technology use, and sustainable innovation across industries.

EuphoriaTech Ventures: Insuring the Future of Risk

At EuphoriaTech Ventures, we’re redefining risk protection by co-building and investing in cutting-edge InsurTech ventures that anticipate tomorrow’s challenges. From AI-driven underwriting to parametric products and usage-based models, we partner with visionary founders creating more agile, transparent, and customer-centric insurance solutions.

EuphoriaTech Ventures is the strategic ally for those pioneering how protection is designed, distributed, and delivered in the digital age.

Explore the future with us: EuphoriaTech Ventures

Learn more about EuphoriaTech Group and how we’re empowering businesses for the future: EuphoriaTech Ventures, EuphoriaTech Advisory, EuphoriaTech Media.